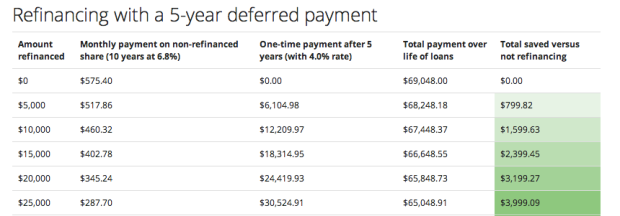

We’re excited to announce the deadline to apply to borrow in the next WeFinance batch is August 8th! We’ve already talked to many great applicants, with developing careers in law, business, tech, health, public policy, education, and other fields, who are ready to stop overpaying interest on their student loans and similar debts by borrowing from real people at a 4% fixed interest rate, and there’s still time to join them. If you’ve used our interest calculator or five-year plan calculator, you know that even refinancing a small share of your existing debt could save you thousands of dollars.

WeFinance borrowers make listings which share a little bit of information about themselves and offer terms for their desired borrowing, then choose how those listings are shared. Many borrowers take advantage of our growing lender network of leaders in these same fields–real people who are sick of getting garbage interest rates on their savings at the bank and who are excited about empowering their future colleagues. Other borrowers also extend the option to loan to their own friends, family, and colleagues, who enjoy the dual benefit of supporting someone they know and getting a better return on their savings. Most borrowers do both, maximizing the amount they’re able to refinance at a lower rate. By refinancing smaller amounts from a variety of individuals, borrowers enjoy an expanded support network, while lenders enjoy less risk. Best of all, everything’s totally automated for both sides: once your bank account is linked, there’s nothing you have to do to get paid or repaid on your loans, whether you’re involved in one loan or one hundred.

Applying just takes a few minutes and is without commitment: we’ll follow up to let you know if you’re a good fit and answer any questions before you decide.

We’ve seen great success with our existing borrowers so far, and if you’ve got an expensive outstanding loan, we hope you’ll consider joining in on the next batch. Be sure to check out our home page and FAQ for more information, and shoot us a note at support@wefinance.co with any questions you have.